25 Feb 2022

The Financial Secretary Mr. Paul Chan Mo-po delivered the 2022/23 Budget speech on 23 February 2022. The budget proposals will need approval by the Legislative Council before taking effect.

Supporting Enterprises

- Reduce profits tax for 2021/22 assessment year by 100%, subject to a HK$10,000 ceiling

- Waive business registration fees of HK$2,000 for 2022/23

- Provide rates concession for non-domestic properties for 2022/23, subject to a ceiling of HK$5,000 per quarter in first two quarters and HK$2,000 per quarter in remaining two quarters

- Continue to waive 75% of water and sewage charges of non-domestic households for 8 months, subject to a monthly cap of HK$20,000 and HK$12,500 respectively

- 100% Loan Guarantee Scheme

- Extend the application of to end June 2023

- Raise the maximum loan amount to 27 months of employee wages and rents, with the loan ceiling raised to HK$9 million

- Extend the maximum repayment period to 10 years

- Offer the option of making partial repayment of principal over a longer period of time

- Continue to grant the 75% rental/fee concession to eligible tenants of government premises/short-term tenancies and waivers for 6 months (100% concession for those closed at the Government’s request)

- Set up a HK$5 billion Strategic Tech Fund to invest in technology enterprises and projects which are of strategic value to Hong Kong

Relieving People’s Hardship

- Reduce salaries tax and tax under personal assessment for 2021/22 assessment year by 100%, subject to ceiling of HK$10,000

- Provide rates concession for domestic properties for 2022/23, subject to a HK$1,500 ceiling in first two quarters and HK$1,000 per quarter in remaining two quarters

- Subsidy of HK$1,000 to each eligible residential electricity account

- Extra half-month allowance of standard CSSA payment, Old Age Allowance, Old Age Living Allowance or Disability Allowance. Similar arrangements will apply to Working Family Allowance and Individual-based Work Incentive Transport Subsidy

- Issue HK$10,000 electronic consumption vouchers in instalments to each eligible Hong Kong permanent resident and new arrival aged 18 or above

- Waive examination fees for candidates sitting 2023 HKDSE Examination

- 100% Personal Loan Guarantee Scheme

- Extend the application period to end April 2023

- Increase the maximum loan amount to nine times of the applicant’s average monthly income during employment, and raise the ceiling to HK$100,000

- Extend the maximum repayment period to 10 years, and the maximum duration of principal moratorium to 18 months

Other key proposals

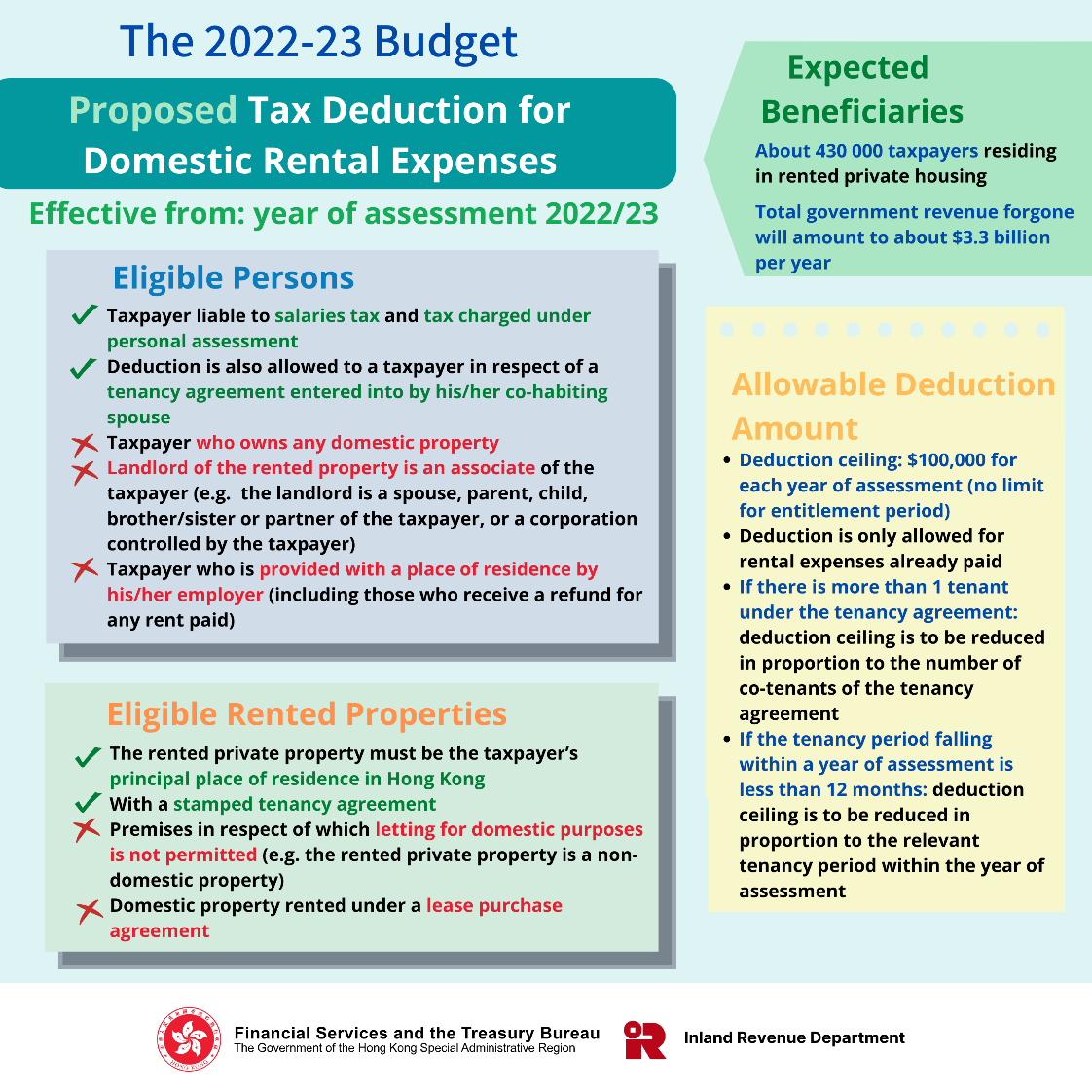

- Introduce a tax deduction for eligible domestic rental expenses from the year of assessment 2022/23. Taxpayers liable to salaries tax or tax charged under personal assessment who do not own any domestic property can claim deduction for the rent paid by him/her or his/her spouse as the tenant. The annual ceiling of the deduction is HK$100,000.

- Propose Rental Enforcement Moratorium for tenants of specific sectors through legislation

- Prohibit landlords from terminating the tenancy of or not providing services to tenants of specified sectors for failing to settle rents on schedule, or taking relevant legal actions against them

- Valid for three months, and be extended for another 3 months if necessary, with the legislation automatically lapsing after 6 months

- Banks will exercise flexibility if the repayment ability of any landlord is affected owing to reduction in his rental income

- Provide tax concessions for the eligible family investment management entities managed by single-family offices

- Provide half-tax concession to attract more maritime enterprises to establish a presence in Hong Kong

- Issue no less than HK$15 billion of inflation-linked retail bonds (iBond), no less than HK$35 billion of Silver Bond and no less than HK$10 billion of retail green bonds in the next financial year

For more information, please contact Ms. Amie Cheung at amie.cheung@lccpa.com.hk